How to Choose the Best Payment Gateway for Your Business

In today’s digital economy, selecting the right payment gateway is essential for ensuring seamless transactions and providing a positive experience for your customers. Whether you run an e-commerce store, a subscription-based service, or a brick-and-mortar business with an online presence, the payment gateway you choose can significantly impact your operations and growth. Here’s a step-by-step guide to help you choose the right payment gateway for your business.

Bilton

12/19/20242 min read

1. Understand Your Business Needs

Before diving into the specifics of payment gateways, take a step back and evaluate your business requirements. Ask yourself:

What types of payments will I accept? Credit cards, debit cards, digital wallets, ACH transfers?

What is my target market? Local, international, or both?

What volume of transactions do I expect?

Do I need recurring billing or subscription management?

Having a clear understanding of your needs will help you narrow down the list of options.

2. Check Compatibility With Your Platform

Your payment gateway should seamlessly integrate with your existing platform, whether it’s an e-commerce website, a mobile app, or a point-of-sale system. Check if the gateway supports your specific CMS, shopping cart, or software framework. Popular platforms like Shopify, WooCommerce, and Magento often have plugins for various payment gateways, making integration easier.

3. Ensure Robust Security Features

Security is a top priority in payment processing. Look for a gateway that offers:

PCI DSS compliance to protect sensitive payment data.

Fraud prevention tools like address verification, tokenization, and 3D Secure.

Data encryption to secure transactions.

These features ensure the safety of your customers’ information and protect your business from potential breaches.

4. Consider Costs and Fees

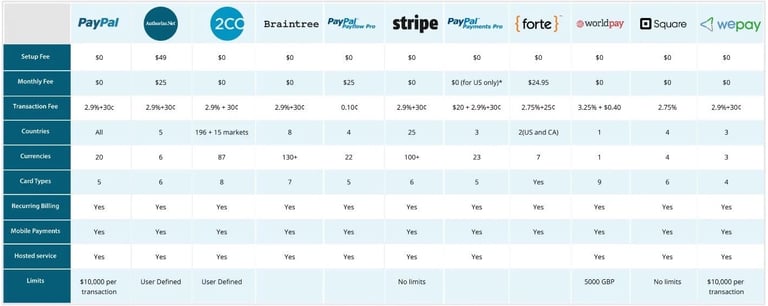

Payment gateways typically charge a combination of setup fees, transaction fees, and monthly fees. Compare the following:

Transaction fees (flat rate or percentage-based).

Monthly maintenance fees.

Chargeback fees.

While it’s tempting to choose the cheapest option, consider the value you’re getting for the cost. Opt for a gateway that balances affordability with features.

5. Evaluate User Experience

The payment process should be smooth and intuitive for your customers. Ensure the gateway:

Supports multiple payment methods.

Allows for mobile-friendly transactions.

Has minimal redirects (for example, staying on your site vs. redirecting to a third-party page).

A seamless checkout experience reduces cart abandonment and boosts customer satisfaction.

6. Look for Scalability

As your business grows, your payment needs may evolve. Choose a gateway that can scale with your business by supporting higher transaction volumes, multiple currencies, or new payment methods. This ensures you won’t need to switch providers as your requirements expand.

7. Assess Customer Support

Payment-related issues can disrupt your business and frustrate customers. Ensure the gateway provider offers:

24/7 customer support.

Multiple support channels (email, phone, chat).

Comprehensive documentation for troubleshooting.

Reliable support minimizes downtime and keeps your operations running smoothly.

8. Research Market Reputation

Before committing to a payment gateway, read reviews and testimonials from other businesses. Look for feedback on reliability, hidden fees, and customer service. A provider with a strong track record in your industry is often a safer choice.

Source: Zoho books

Popular Payment Gateways to Consider

While there are numerous options available, some widely trusted payment gateways include:

PayPal: Easy setup and global reach.

Stripe: Developer-friendly and highly customizable.

Square: Ideal for small businesses with POS needs.

Authorize.Net: Comprehensive features for businesses of all sizes.

Adyen: Great for international businesses.

Conclusion

Choosing the right payment gateway is a critical decision that can influence your business’s success. By carefully evaluating your needs, comparing features, and prioritizing security and user experience, you can select a gateway that supports your operations and enhances customer satisfaction. Take the time to research and choose wisely—it’s an investment in your business’s future.

Hours

Mon-Fri 9am - 6pm

Contacts

info@fynteq.com

About:

Expert fintech consulting and strategy services, backed by 10+ years of experience in Payment and crypto industries.